estate tax changes for 2022

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The lifetime exemption is the total amount of money that you can give away free of estate tax in life andor death.

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

For single taxpayers and married individuals filing separately the standard.

. Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts. What to Know About Potential Changes to Estate Tax in 2022. Learn How EY Can Help.

If you have a sizeable estate that you would like to pass on to your children without being heavily taxed you. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Answer Simple Questions About Your Life And We Do The Rest.

Arizonas 2022 tax changes are among the nations most complex as they involveamong other thingsthe unwinding of a prior ballot measure. The Estate Tax is a tax on your right to transfer property at your death. Learn How EY Can Help.

The USs Scottie Scheffler the worlds No. 1 ranked mens golfer won the 2022 Masters on Sunday defeating Northern Irelands Rory McIlroy by three strokes after shooting a. Ad From Fisher Investments 40 years managing money and helping thousands of families.

Durkin Steven L. Major Tax Changes for 2022 You Need To Know 1. File With Confidence Today.

Choice of leaving estates to the surviving spouse because it preserves the exemption for future beneficiaries. Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a total of 11700000 for estates of decedents who died in 2021. The BBBA would restore the exemption to pre-TCJA levels for 2022 and after.

Posted in Trusts Estates. It consists of an accounting of. Throughout 2021 Congress and the Executive Branch proposed tax.

These changes may impact you if you have a taxable estate. Get information on how the estate tax may apply to your taxable estate at your death. As of January 1 2022 the federal gift and estate tax exclusion amount as well as the exemption from generation-skipping transfer.

Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts. Gift tax annual exclusion increases from 15000 to. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

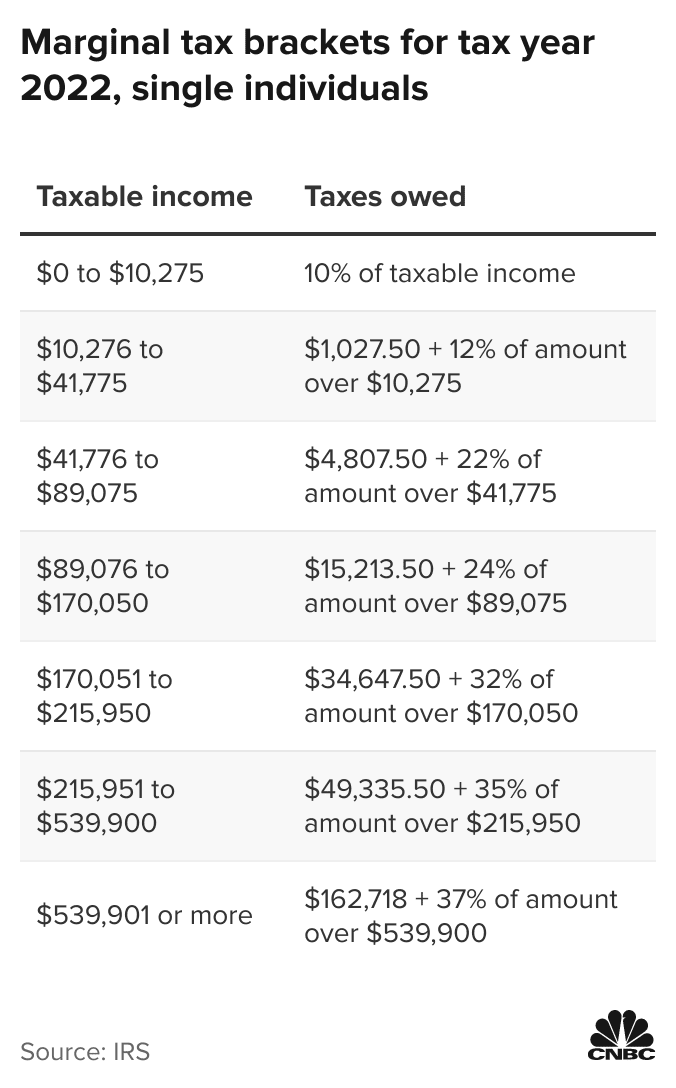

Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. Iowa is one of six states that has an inheritance tax or death tax a death tax is a tax collected from the person you are passing your property or assets to upon your death. Tax Brackets Increase for All Filing Statuses Your federal taxes are calculated based on the tax brackets for your.

By Robert F. Gift tax annual exclusion increases from 15000 to. Ad Estate Trust Tax Services.

Lifetime Exclusion Increases to 12060000. The exclusion amount is for 2022 is 1206. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service.

The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. Ad Estate Trust Tax Services. For married couples filing jointly the standard deduction rises to 25900 up 800 from the prior year.

The 117M per person gift and estate tax exemption will remain in place and will be increased. No Changes to the Current Gift and Estate Exemption Provisions Until 2025. Friedman on January 3 2022.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Buy To Let Tax Changes In 2022 Capital Gains Tax Let It Be Buy To Let Mortgage

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Plan Now To Avoid A Tax Bomb Later Why Asset Location Matters

Happy 2022 Texas Has Several New Laws Coming Into Force With The New Year Do You Know What These New Laws Are Expect Changes In 2022 Texas Law Law Office Estate Tax

Fiscal Cliff Infographic Small Business Association Payroll Taxes Estate Tax

Buy The Telegraph Tax Guide 2021 45th Edition By Joe Mcgrath Hardcover In United States Cartnear Com In 2022 Tax Guide Inheritance Tax Tax Return

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Pin By Tina On Irs In 2022 Irs Taxes Capital Gains Tax Tax Brackets

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

How To Fill Out A W 4 Form In 2022 Guide And Faqs Nerdwallet W4 Tax Form Finance Investing Changing Jobs

Form W 4 Employee S Withholding Certificate 2019 Mbcvirtual In 2022 Changing Jobs Federal Income Tax Income Tax