crypto tax calculator uk

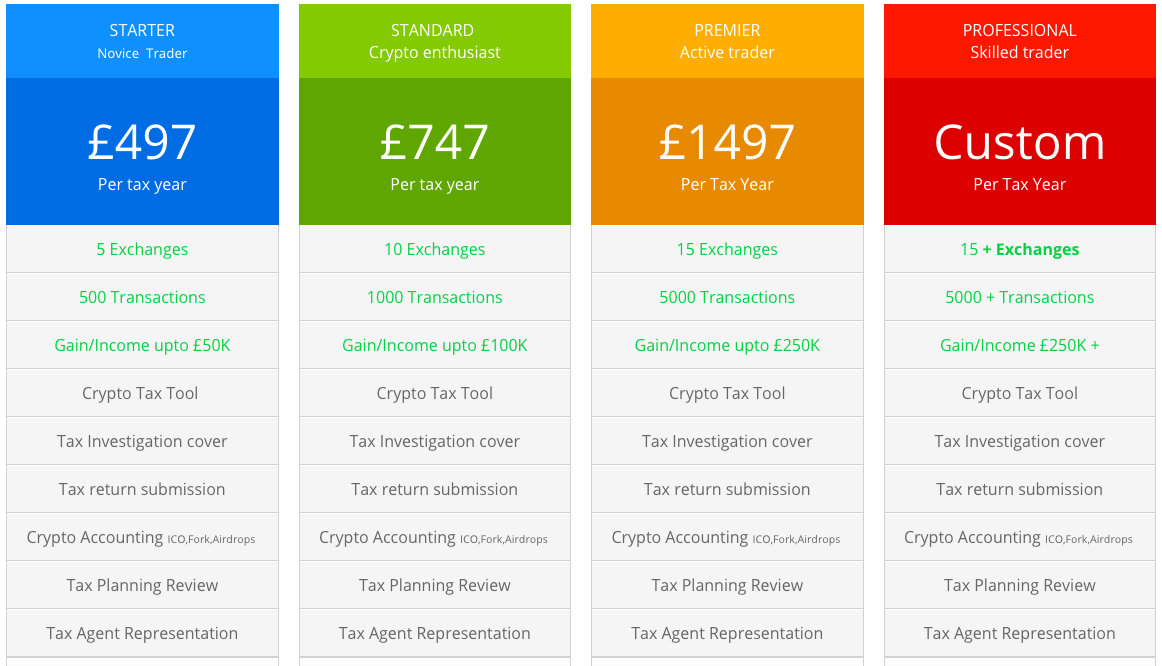

Crypto CPAs in UK. If youre a professional crypto investor in need of a reliable tax calculator Zenledger might be a perfect fit.

Best Bitcoin Tax Calculator In The Uk 2021

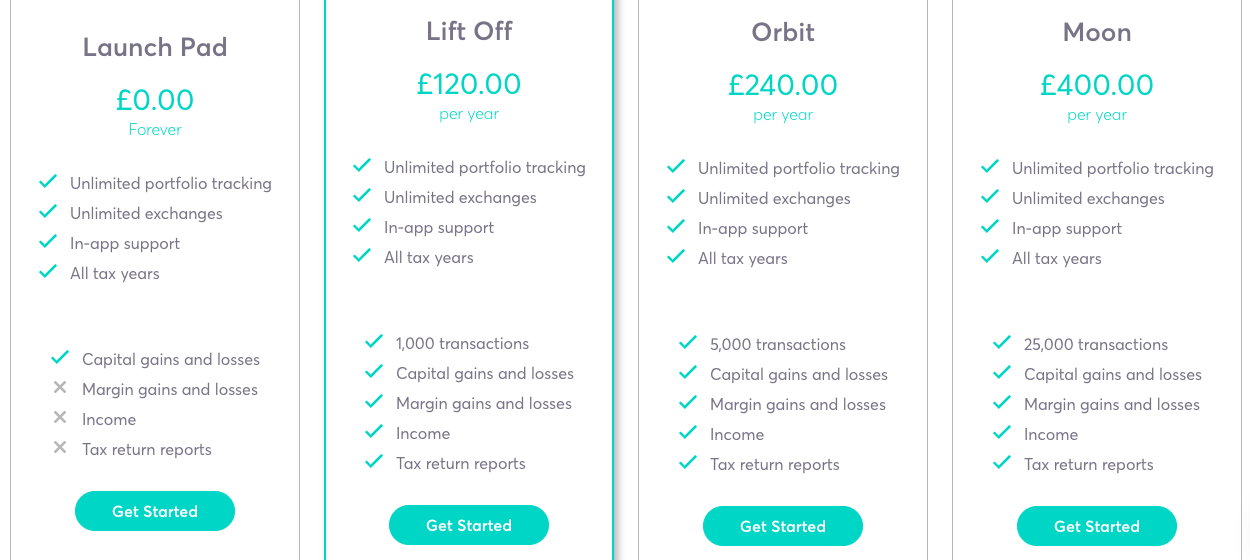

Ive used Recap for many years Helps me calculate my tax and allows me to focus on trading.

. Fund Your Account and Start Trading Cryptocurrencies Today. Ad Join the New Digital Economy with TradeStation Crypto to Learn About Invest in Crypto. You simply import all your transaction history and export your report.

Sort out your crypto tax nightmare. Online Crypto Tax Calculator with support for over 400 integrations. HMRC also suggests what cost you can deduct from disposal proceeds to calculate capital gain.

This matters for your crypto because you subtract. Your first 12570 of income in the UK is tax free for the 20212022 tax year. You might need to pay Capital Gains Tax when you.

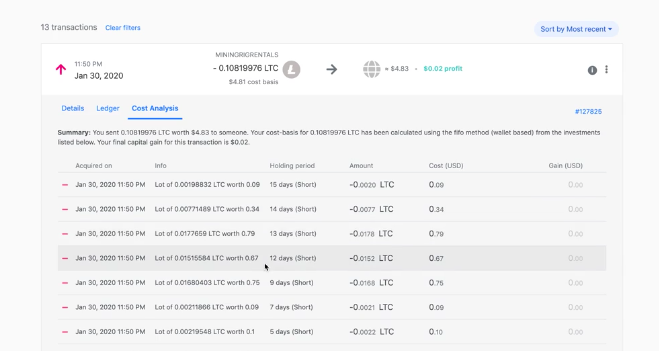

Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes. UK Crypto Tax Calculator. Zenledgers dashboard is simple making it easy for a non-technical person to navigate the platform and calculate their tax without any trouble.

Supports DeFi NFTs and decentralized exchanges. The original software debuted in 2014. CoinTrackinginfo - the most popular crypto tax calculator.

Automated Crypto Trading With Haru. Anyone in the UK who has had dealings with cryptocurrencies may need to pay tax. Ad Find the Next Crypto Gem on KuCoin1 Out of 4 Crypto Holders Worldwide Is with KuCoin.

Or Sign In with Email. This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication. Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how.

You pay 1286 at 20 tax rate on the remaining 6430 of your capital gains. Straightforward UI which you get your crypto taxes done in seconds at no cost. To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat.

Sign In with Google. Its important that you report your profits accurately and pay any tax due by the deadline if you want to avoid financial penalties. Crypto tax software is a tool that allows you to prepare your taxes for your cryptocurrency assets.

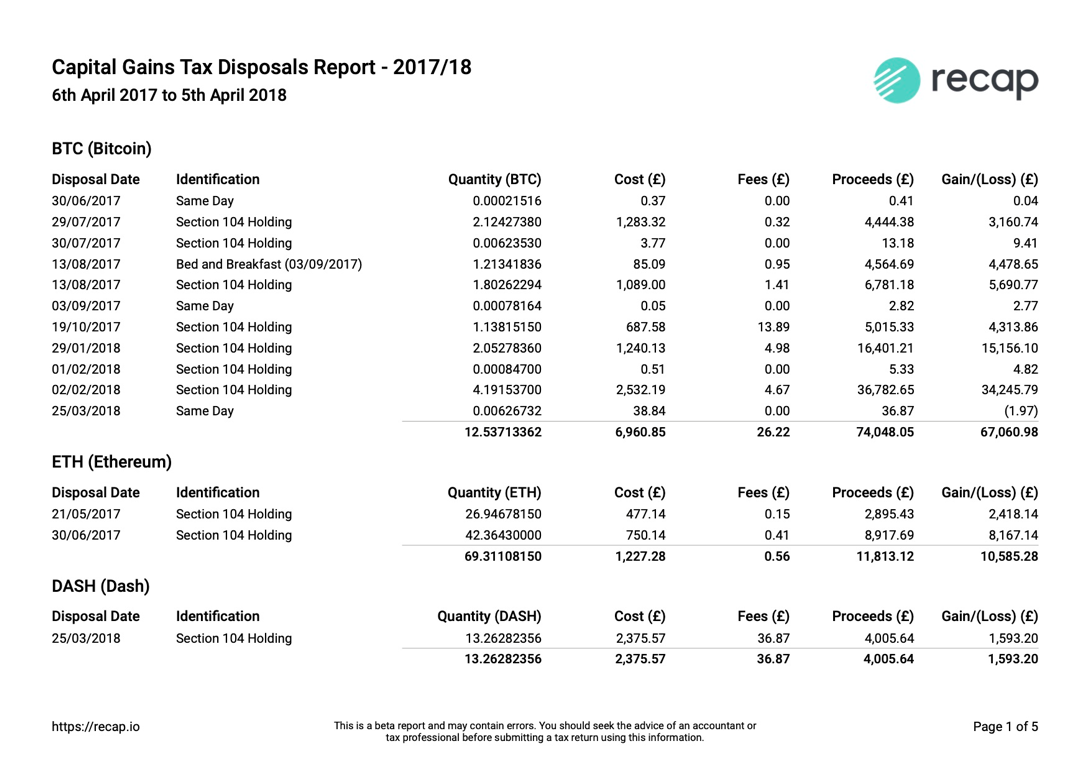

It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines. This allowance was 12500 for the 20202021 tax year. It supports many exchanges crypto assets and fiat currencies.

In many cases this sort of software also includes a complete crypto portfolio tracker and analysis tool to get a bird eye. Exchange your tokens for a different type of cryptoasset. Recap is simply the best Crypto Tax software on the market.

CryptoTaxCalculator is a software solution designed to automate your crypto tax nightmare saving the pain of manually calculating taxes for each transaction. When to check. You pay no CGT on the first 12300 that you make.

You pay 127 at 10 tax rate for the next 1270 of your capital gains. Crypto Tax Calculator is one of them designed specifically for HMRC tax laws. Weve teamed up with Cryptotaxcalculator to facilitate your crypto tax calculation.

It allows you to calculate the profit and loss from cryptocurrency trading calculate capital gains or losses and take deductions on expenses. Crypto Tax UK Guide for 2022. Capital gains tax CGT breakdown.

If youre not sure whether you need to pay tax or how much tax you will need to pay weve got. Calculate and report your crypto tax for free now. This means you can get your books up to date yourself allowing you to save significant time.

49 for all financial years. BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. For individuals income tax supersedes capital gains tax and applies to profits.

Getting Started is Easy. Our software supports the unique HMRC reporting requirements including UK specific rules around mining staking and airdrops. File your crypto taxes in the UK Learn how to calculate and file your taxes if you live in the United Kingdom.

UK citizens have to report their capital gains from cryptocurrencies. Koinly helps UK citizens calculate their crypto capital gains. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Use your tokens to pay for goods or services. If you have less than 100 cryptoasset transactions per year it may be worthwhile to pay the price of 39 per year to double-check if all of. Up to 500 USDT in bonuses for new users Trade Anytime Anywhere.

For companies profits or losses from cryptocurrency trading are part of the trading profit rather than a chargeable gain. The only Crypto Tax Software with end-to-end encryption and also the best customer service in the space with specialised crypto accountants working with them. 12570 Personal Income Tax Allowance.

Simply upload or add the transaction from the exchanges and wallets you have used along with any crypto you might already own and well calculate your capital gains. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. The platform is also to start using Koinlys crypto tax calculator.

Basic tax rate of 20 between 12501 to 50000 income. See the full HMRC guidance here. HMRC has published guidance for people who hold.

CryptoTaxCalculator performs tax calculations with a high degree of accuracy carefully considering complex tax scenarios. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. Since then its developers have been creating native apps for mobile devices and other upgrades.

We have a list of certified tax accountants in the UK that specialise in cryptocurrencies. You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc. Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD.

Koinly has helped hundreds with their crypto. Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. Beyond that level there are three tax brackets in the UK.

Capital gains tax report.

![]()

Cointracking Crypto Tax Calculator

Track Your Cryptocurrency Portfolio Taxes Cointracker Is The Most Trusted And Secure Cryptocurrency Portfolio Tr Tax Guide Cryptocurrency Buy Cryptocurrency

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021

Crypto Tax Calculator Review Everything You Need To Know About This Cryptocurrency Tax Software Tax Software Cryptocurrency Trading Cryptocurrency

![]()

Cointracking Crypto Tax Calculator

Capital Gains Tax Calculator Ey Global

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Tax Calculator Calculator Design Financial Calculator Helping People

Best Bitcoin Tax Calculator In The Uk 2021

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

Calculate Your Crypto Taxes With Ease Koinly

Calculate Your Crypto Taxes With Ease Koinly

Best Bitcoin Tax Calculator In The Uk 2021

The Uk Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger