are campaign contributions tax deductible in 2019

While there is no tax. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

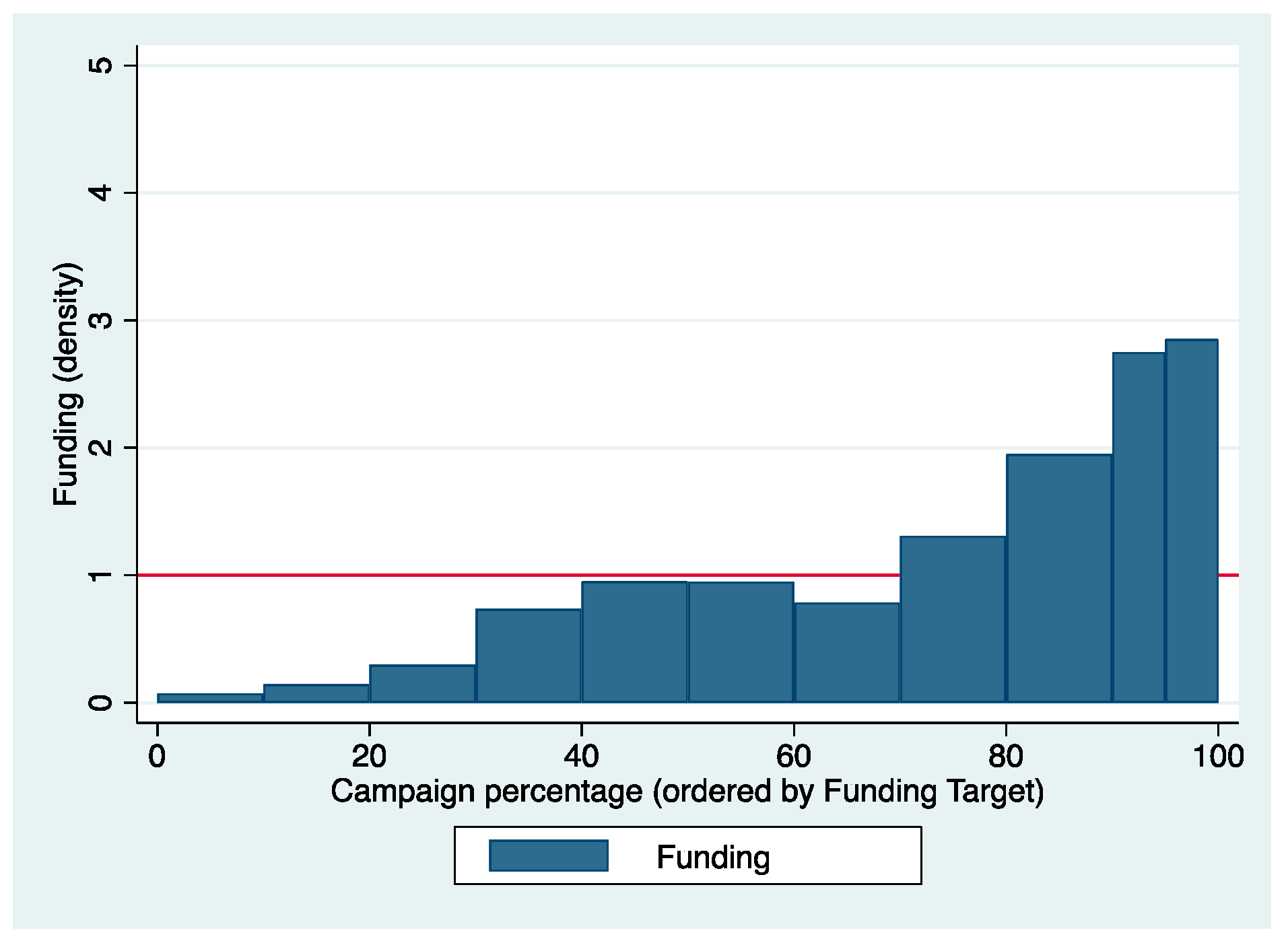

Jrfm Free Full Text Legitimacy And Reciprocal Altruism In Donation Based Crowdfunding Evidence From India Html

As circularized in Revenue Memorandum Circular RMC 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the candidate to whom they were given the reason being that such contributions were given not for the personal expenditure or enrichment of the concerned candidate but for the purpose of utilizing.

. For 2019 each individual is allowed to take 12200 off of income while couples can take 24400 off. The answer is no donations to political candidates are not tax deductible on your personal or business tax return. Like Arkansas Ohio only allows for contributions to candidates in statewide elections.

Qualified contributions are not subject to this limitation. An anonymous contribution of cash is limited to 50. When people do give most political donations are large given by a few relatively wealthy people.

You cannot deduct expenses in support of any candidate. But the federal tax code doesnt allow you to take a deduction for any political donations you make. Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC.

Its only natural to wonder if donations to a political campaign are tax deductible too. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. It has been updated for the 2019 tax year.

Otherwise the donations are not exempt from donors tax and not deductible as a political contribution on the part of the donor. 100 limit on cash contributions A campaign may not accept more than 100 in cash from a particular source with respect to any campaign for nomination for election or election to federal office. Count me among those smaller donors who has given a bit here and there to campaigns.

There will be a. However donations to ActBlue Charities and other registered 501 c 3 organizations are tax deductible. While inside the software and working on your return type charitable donation in the Search at the top of the screen you may see a magnifying glass there.

Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax. Yes you can deduct them as a Charitable Donation if you file Schedule A. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

Generally only a small minority of total contributions come from those who give 200 or less. For many people the tax break from Uncle Sam is almost as big a motivating factor as altruism. Political donations to federal candidates and committees are not deductible from federal income taxes whether they are made online or in person.

While tax deductible CFC deductions are not pre-tax. Can I deduct my contributions to the Combined Federal Campaign CFC. A 75 tax deduction may be claimed for 400 contributed a 50 rate for any contribution that is 400 or more and a 33 rate for each contribution that is 400 or more.

How to get to the area to enter your donations. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. Wrongfully claiming political contributions can and will attract the attention of the Internal Revenue Service and can lead to an assessment of additional taxes due penalties and interest.

It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible. 50 limit on anonymous contributions. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

Are political donations tax deductible 2019. You can claim anywhere from 650 to 830 annually. A corporation may deduct qualified contributions of up to 25 percent of its taxable income.

This Standard Deduction is a flat deduction the IRS offers to everyone. 100 limit on cash contributions A campaign may not accept more than 100 in cash from a particular source with respect to any campaign for nomination for election or election to federal office. Whether you actually end up getting a deduction depends mainly on whether or not you do what is called itemizing your deductions.

Political donations are not tax deductible on federal returns. This stems from the presumption that campaign contributions are meant to be utilized by the candidate for his or her campaign and not for personal use and are thus not a proper inclusion to the candidates taxable income. We all know that donations to charity are tax deductible.

The same goes for campaign contributions. The answer is no political contributions are not tax deductible. Any amount in excess of 50 must be promptly disposed of and may be used for any.

The tax rate for amounts over 750 is 33. The Natural State grants tax credits for statenot federalcampaign contributions of up to 50 for an individual 100 for a couple and it can be spread over multiple candidates political action committees approved by Arkansas and parties. Political campaigns from national down to local rely on contributions to operate.

So you might feel that you deserve a tax break when you support the democratic process by making a campaign contribution. Likewise gifts and contributions to 501 c 4 social welfare organizations are not deductible as charitable contributions.

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

Political Financing Handbook For Candidates And Official Agents Ec 20155 June 2019 Archived Content Elections Canada

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

Political Financing Handbook For Candidates And Official Agents Ec 20155 June 2019 Archived Content Elections Canada

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

How Much Should You Donate To Charity District Capital

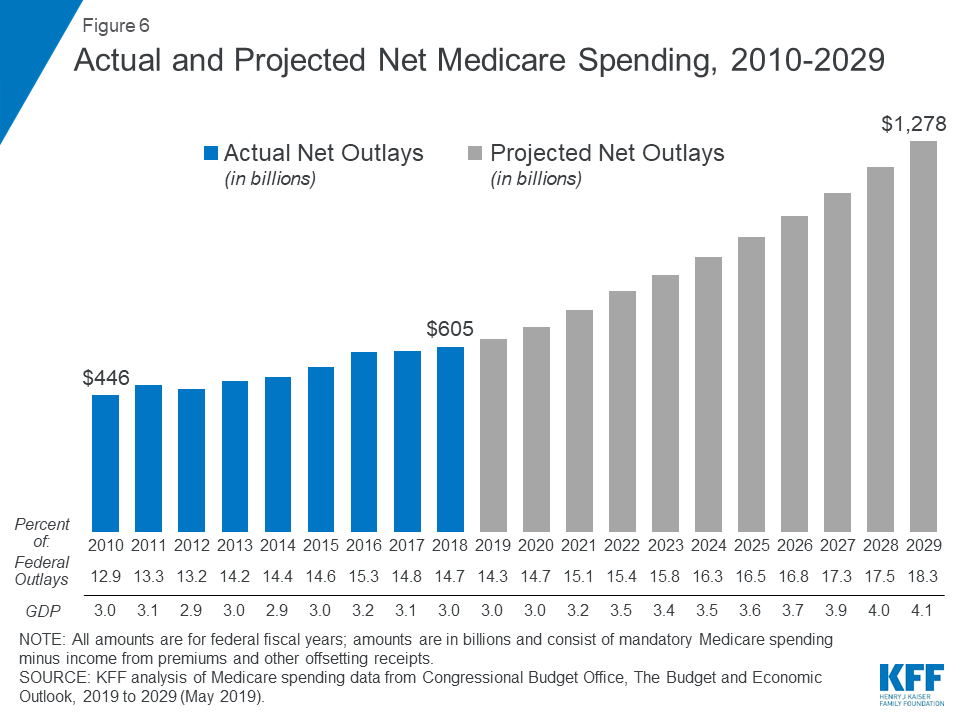

The Facts On Medicare Spending And Financing Kff

Ask The Tax Whiz Should Candidates Parties Campaign Donors Pay Taxes

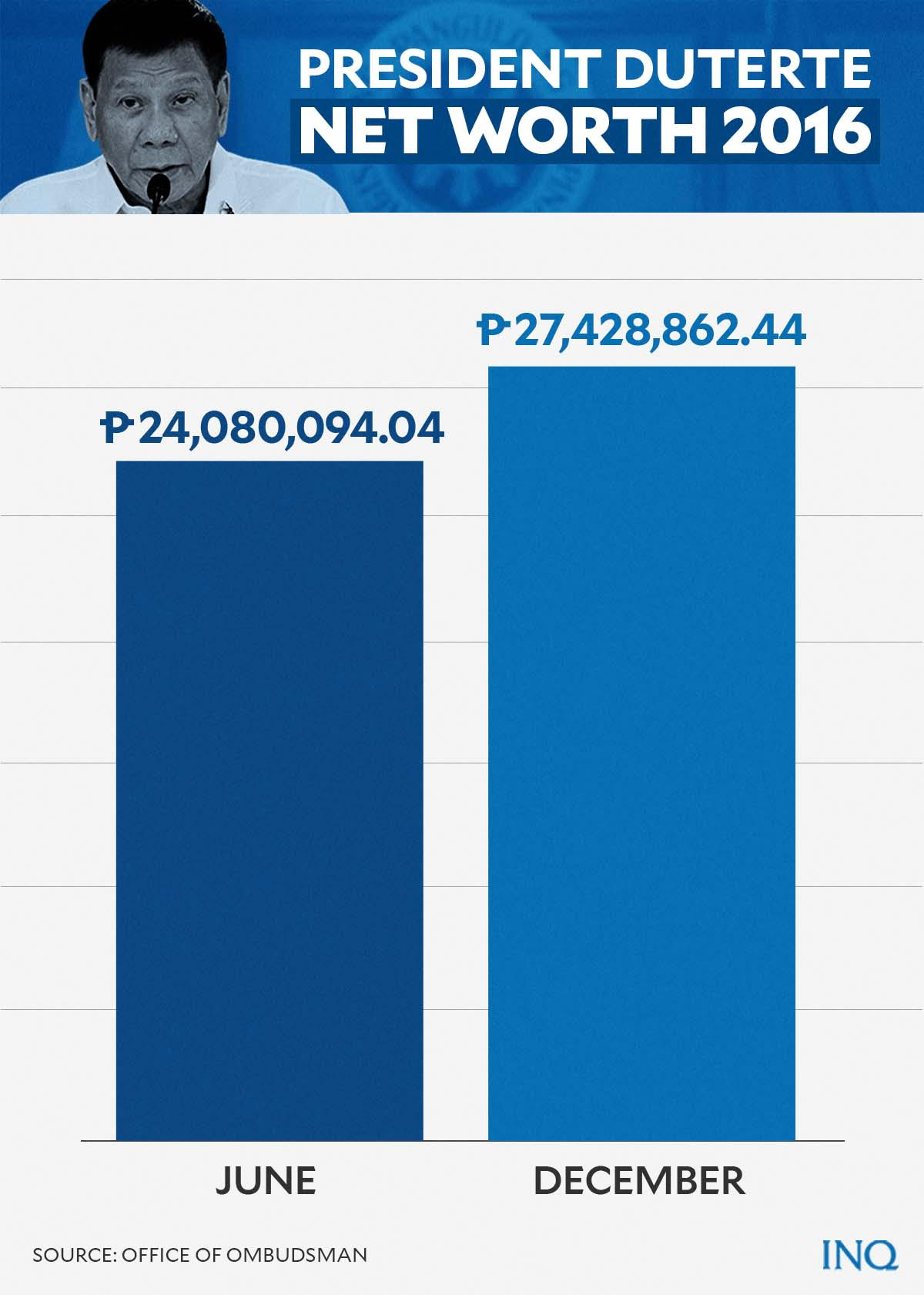

Excess Campaign Funds Taxable Income If Candidates Keep It Inquirer News

Are Donations To Political Parties Tax Deductible Uk Ictsd Org

Taxability Of Campaign Contributions Atty Rodel C Unciano

Utah State Tax Benefits Information

Facts About Pacs The Role Of Political Programs And The Importance Of Engagement The Bulletin

Are Campaign Contributions Tax Deductible

How To Deduct Appreciated Stock Donations From Your Taxes Cocatalyst

Are Political Donations Tax Deductible Credit Karma Tax

Taxability Of Campaign Contributions

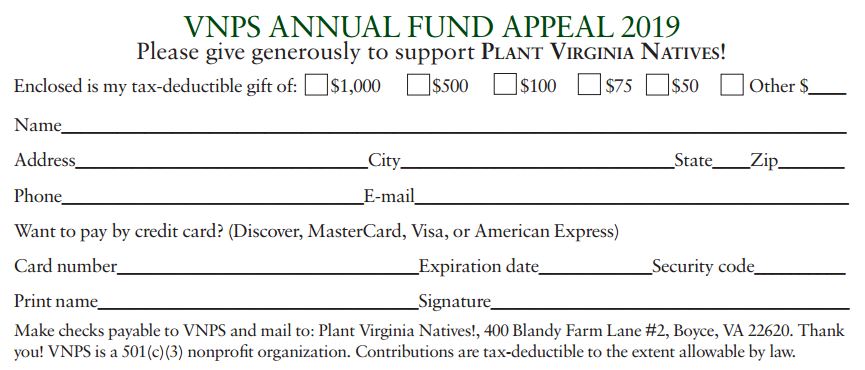

Print Plant Virginia Natives 2019 Annual Campaign Donation Form Virginia Native Plant Society